Author: Dr William Guo, qualified Dutch lawyer (advocaat) and founder of Jing Law Firm

Publication date: 2 September 2020

Introduction: one new law, six key questions

On 23 June 2020 the Dutch legislature adopted a new law called the Implementation Act on the Registration of Ultimate Beneficial Owners of Companies and Other Legal Entities (the “UBO Registration Law“). This new law requires various companies and organisations incorporated/established under Dutch law to obtain, register and update certain information regarding their ultimate beneficial owners (“UBOs“). The registration requirement will become effective as of 27 September 2020. Non-compliance may result in administrative fines up to € 21,750 and/or criminal sanctions including imprisonment up to two years.

This article aims to provide international investors that have incorporated or established companies or organisations in the Netherlands (or intend to do so) with certain key information regarding the UBO Registration Law that may be helpful for them to comply with this new legislation. The following six key questions will be briefly answered in this article:

- Which companies/organisations must comply with the UBO Registration Law?

- What are the main obligations imposed by the UBO Registration Law?

- Who is a UBO?

- What information regarding a UBO must be collected and registered?

- When must the relevant UBO information be registered?

- How can the relevant UBO information be registered?

1. Which companies/organisations must comply with the UBO Registration Law?

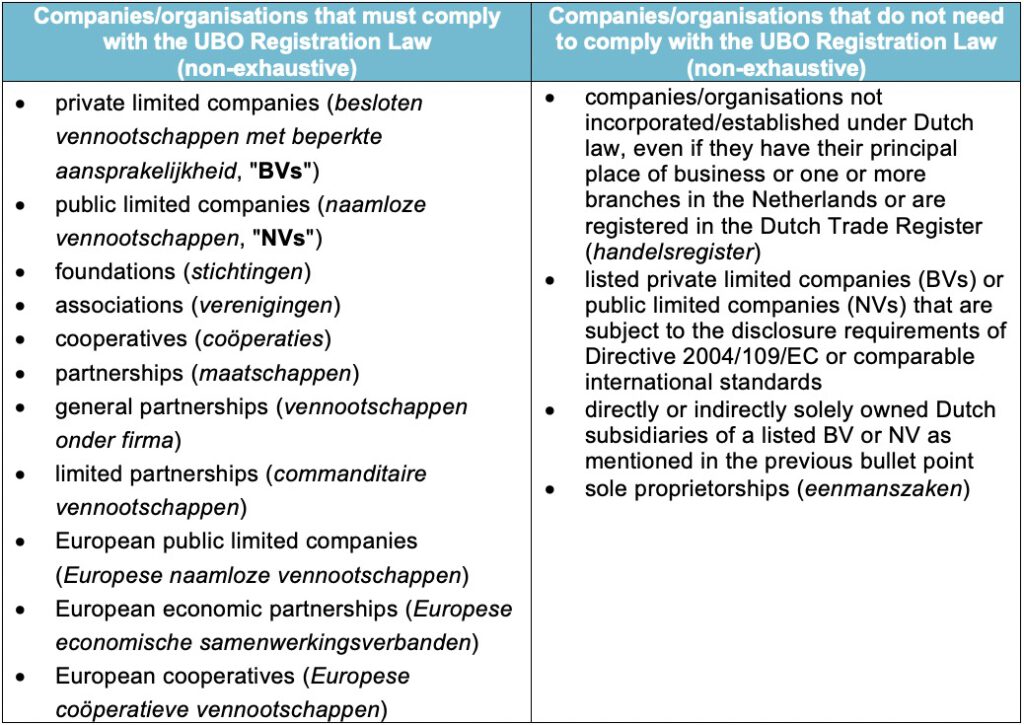

To the extent relevant for international investors, the following companies/organisations that are already or will be incorporated or established under Dutch law must comply with the UBO Registration Law. The table below also sets out the companies/organisations that do not need to comply with this new law (the list is not exhaustive, as this article only aims to provide information that is relevant for international investors).

2. What are the main obligations imposed by the UBO Registration Law?

If the UBO Registration Law applies to your company/organisation, then it must comply with the following obligations:

- ascertaining the identity of its UBO/UBOs;

- obtaining the information required by the UBO Registration Law regarding its UBO/UBOs (e.g. name, date of birth etc., for details see question 4 below);

- obtaining documents required by the UBO Registration Law regarding to its UBO/UBOs (e.g. copies of passports, shareholders’ register etc., for details see question 4 below);

- monitoring its UBO information and keeping the relevant UBO information and documents up to date;

- registering the required UBO information and filing the relevant UBO documents with the Dutch Chamber of Commerce (Kamer van Koophandel); and

- updating the UBO information and the UBO documents registered/filed with the Dutch Chamber of Commerce in case of change of such information/documents.

In addition, the UBO Registration Law also imposes an obligation on the UBOs to provide the information required by the UBO Registration Law. Non-compliance may lead to criminal sanctions.

3. Who is a UBO?

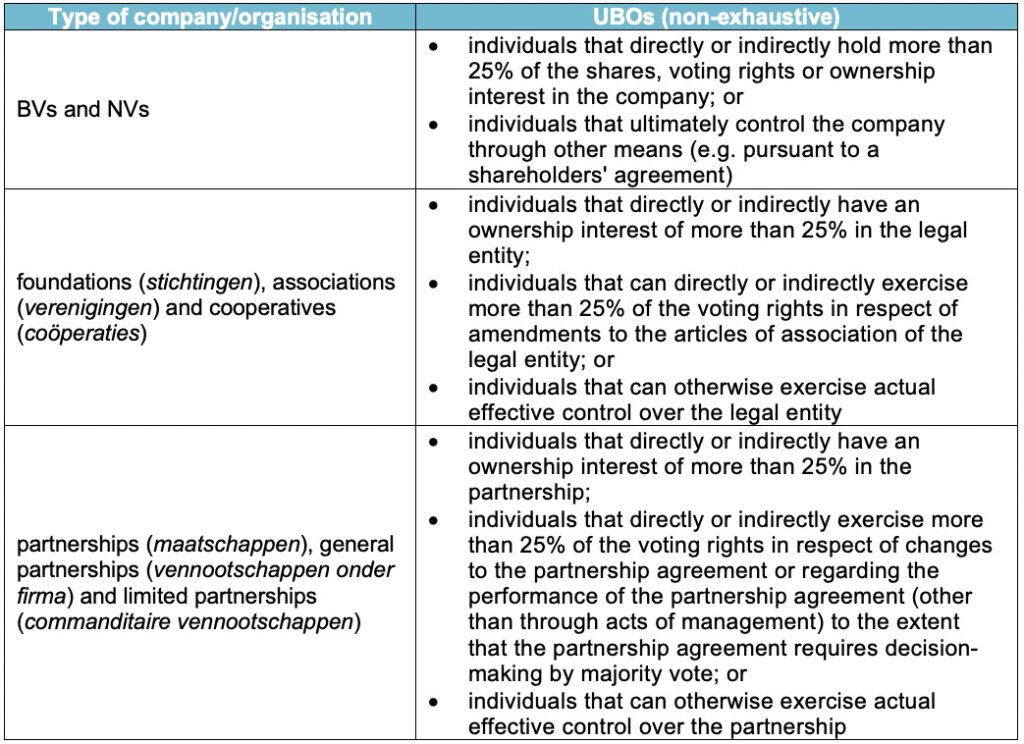

In the UBO Registration Law, a UBO is defined as a natural person that is the ultimate owner of or has control over a company (vennootschap) or other legal entity. How this definition will exactly de interpreted by the relevant Dutch authorities still remains to be seen, as the UBO Registration Law is a new legislation. Based on the implementation of the existing Dutch Anti-Money Laundering and Anti-Terrorist Financing Act that has a similar UBO definition, the table below sets out a non-exhaustive overview of the individuals that in any event qualify as UBOs for some common types of companies/organisations.

Each company/organisation to which the UBO Registration Law applies must identify and register at least one UBO. If no UBO can be identified based on the criteria mentioned in the above table, one or more individuals holding the position of senior management official(s) shall qualify as UBO(s) of the company/organisation.

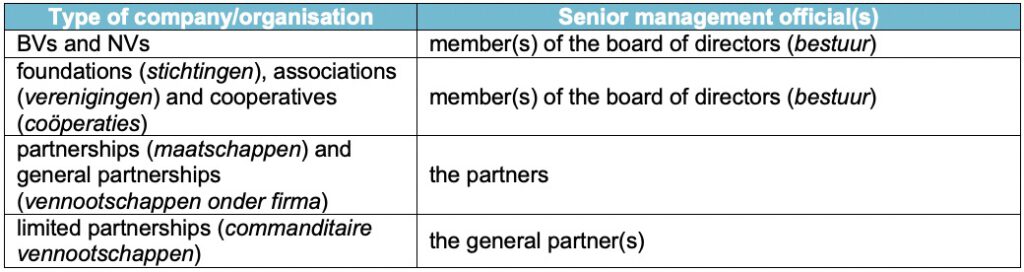

The table below sets out the individuals that qualify as senior management officials of some common types of companies/organisations. If the position of senior management official is fulfilled by a legal entity, the UBO(s) shall be the individual(s) that fulfil(s) the position of senior management official(s) of that legal entity.

4. What information regarding a UBO must be collected and registered?

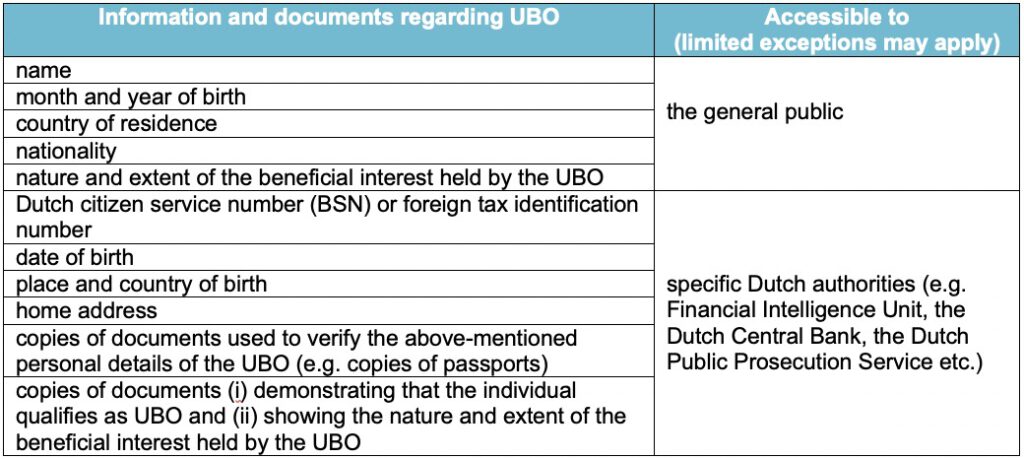

The table below sets out the information and documents regarding a UBO that must be collected by the relevant companies/organisations and registered/filed with the Dutch Chamber of Commerce. The table also sets out who will have access to such information and documents.

5. When must UBO information be registered?

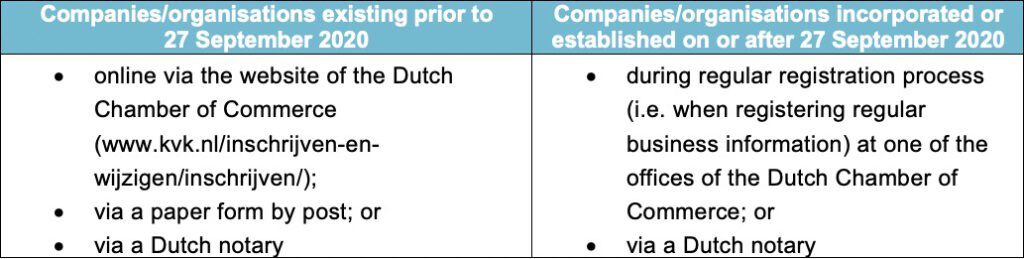

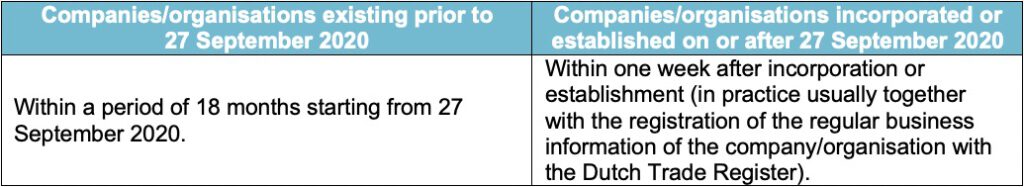

As to the timing of registration, the UBO Registration Law makes a distinction between companies/organisations incorporated or established before 27 September 2020 and those that are incorporated or established on or after that date. The respective deadlines are indicated in the table below.

6. How can UBO information be registered?

The table below sets out how existing and new companies/organisations can register their UBO information. The Dutch Chamber of Commerce will not charge additional fees for the registration of UBO information (new companies or organisations to be incorporated/established will need to pay the standard fee for regular business registration, currently being € 50).